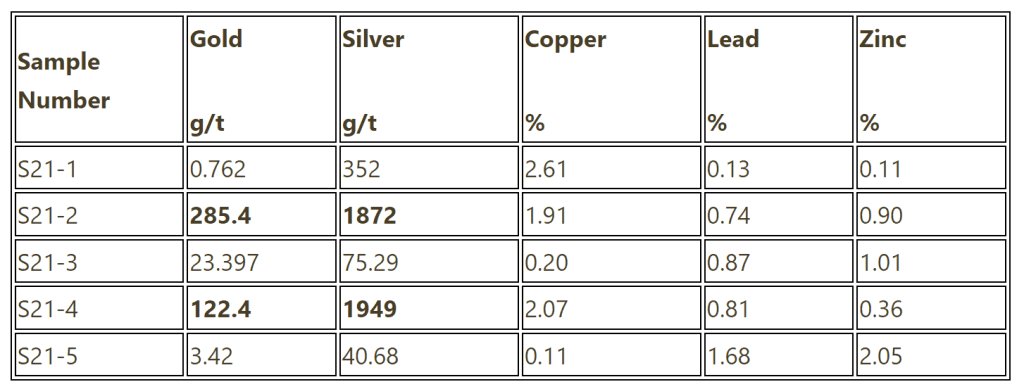

285.4 g/t GOLD AND 1949 g/t SILVER ASSAYS FROM SURFACE SAMPLING ON THE SWANN ZONE FROM THE HARRY PROPERTY

Vancouver, British Columbia –19, 2022 – Optimum Ventures Ltd. (“Optimum” or the “Company”) (TSXV:OPV), reports it has received further highly encouraging results from a limited surface exploration program conducted on the Harry Property in Northwestern British Columbia, in late 2021 prior to the onset of winter. The sampling program was conducted on and in the region of the Swann zone, which is exposed over a small area and consists of quartz and semi massive to massive mineralization with visible gold within an intensely altered zone. Determination of its true width and strike length will be part of the focus in the 2022 exploration program.

Table 1 – Swann Zone Surface Sampling

Grab samples are solely designed to show the presence or absence of any mineralization and to characterize the metal tenor in this mineralization. Grab samples are by definition selective and not intended to provide nor should be construed as a representative indication of grade or mineralization at the property; and the grab samples analysed from the property reflect a broad range in grade from below detection limit to the grades highlighted herein.

Following the surface sampling program, Optimum completed four short diamond drill holes on the Swann zone as a requirement under the option agreement on the property. Due to a quick onset of winter and Covid complications, these four drill holes were boxed and put in locked storage prior to being logged. Optimum geologists have now retrieved the drill core from storage and have logged, split and sent it for assay. Logging of the core has indicated up to 6 m of semi-massive to massive mineralization associated with highly altered sericitic rocks and quartz veining. Cut core showed silvery galena, indicative of silver in the Stewart area, green sphalerite and dull black stringers of tetrahedrite. In cut surface samples, fine visible gold is observed in the sphalerite, galena and tetrahedrite. Photos of cut core showing massive sulphides are shown on the Company website.

The Harry Property is comprised of three contiguous claims covering area of approximately 1,333 hectares along the Granduc Access Road near Stewart, British Columbia. The property is bordered by Ascot Resources Ltd. to the east and south, Pretium Resources Inc, to the north, and Scottie Resources Corp to the west. The property lies along the northwestern portion of a geological corridor prospective for gold-silver mineralization that host several former and operating mines. The property hosts several 500 metre (m) wide zones of intense alteration that trend northwest along the claim length. Within this intense alteration, sericite with abundant pyrite is prevalent. Quartz veins, Quartz breccias and semi-massive sulphides occur within these alteration zones. This type of alteration and mineralization is found at the nearby gold deposits currently being developed by Ascot Resources Ltd.

Work completed in late 2021, while only on about 10% of the property, indicates that sulphide zones occur within quartz bearing structures trending both east-west (south dip). Where these structures are crosscut by northwest trending structures (dipping east), semi-massive to massive sulphides occur. Within these sulphides, sphalerite, galena, tetrahedrite, chalcopyrite and pyrite are present. Fine visible gold is occasionally present within the massive mineralization. The Swann zone is several hundred meters east of the Milestone, where 2020 trench sampling returned 7.86 oz/ton gold (269.5 g/t) across a 2 metre width.

About Optimum

For more information visit www.optimumventures.ca.

Qualified Persons

Mr. Edward Kruchkowski P.Geo., a member of the Company’s Board of Directors, is a qualified person for the purposes of National Instrument 43-101 and has reviewed and approved the technical information contained herein.

Quality assurance/ quality control

The company inserts banks and standards within the sample stream to improve quality control. MSA labs, who perform Optimum Ventures assaying, also perform internal standards and banks as a check on their analysis. The company retains all pulps and rejects for future analysis.

FOR FURTHER INFORMATION PLEASE CONTACT:

Tyler Ross

Optimum Ventures Ltd.

Tel: (604) 428-6128

info@optimumventures.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. The use of any of the words “could”, “intend”, “expect”, “believe”, “will”, “projected”, “estimated” and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company’s current belief or assumptions as to the outcome and timing of such future events including, among others, assumptions about future prices of gold, silver, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining government approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, the impact of the COVID-19 pandemic, availability of equipment, availability of drill rigs, and anticipated costs and expenditures. The Company cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond the Company’s control. Such factors include, among other things: risks and uncertainties relating to Optimum’s ability to complete all payments and expenditures required under the Option Agreement; and other risks and uncertainties relating to the actual results of current exploration activities, the uncertainty of reserve and resources estimates; the uncertainty of estimates and projections in relation to production, costs and expenses; risks relating to grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with adjacent properties and the Company’s expectations; operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); metal price fluctuations; environmental and regulatory requirements; availability of permits, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, political risks, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks involved in the mineral exploration and development industry, and those risks set out in the filings on SEDAR made by the Company with securities regulators. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, other than as required by applicable securities legislation.